Swish your way to greener payments

Next time you indulge in an ice cream treat, leave the cash behind. Opting for a digital payment method like Swish is a savvy move for the environment. That's the key finding from a recent study conducted by researchers at KTH, shedding light on the environmental impact of different payment methods.

Every day, Swedes carry out an average of two payment transactions. Whether purchasing a new refrigerator or grabbing a snack, we're presented with various payment options: payment apps, e-invoices, card payments, or cash. Yet, few consider the environmental implications of these transactions.

Behind our digital payments lie complex computer systems operating non-stop, requiring substantial energy for security and backup functions.

Niklas Arvidsson , Professor at the Department of Industrial Economics and Management, spearheaded this research commissioned by the Riksbank. The goal? To evaluate how different payment methods influence our climate.

Immense strain

If the Riksbank is to introduce an e-krona it wants to ensure that it does not become an environmental villain like Bitcoin.

“Cryptocurrencies like Bitcoin consume significant energy due to their verification-intensive design,” explains Arvidsson. “This places immense strain on data and internet capacity.”

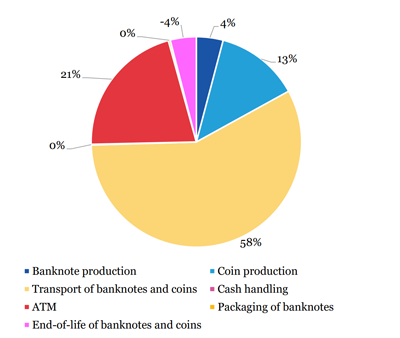

The study compares payment methods - apps, cards, giro payments, and cash-revealing cash as the biggest environmental culprit. Banknotes, primarily made of cotton, demand vast amounts of water and chemicals for production. Moreover, their metal-based security features and the mining required for coin metals further contribute to their footprint. Transportation accounts for cash's largest environmental cost, with CIT vehicle journeys emitting substantial CO2.

”We have calculated the effect of using biofuel instead of diesel, and electric vehicles where it works – measures that significantly would lower the emissions,” says Niklas Arvidsson.

Cards gradually declining

While cash dominates environmental impact, other payment types are relatively similar. Cards are made of plastic materials, contain metal parts and require transport. In addition, card readers that consume energy are needed.

“Payment apps eliminate the need for plastic cards,” notes Arvidsson. "Still, they have a larger carbon footprint than cards because even if you use something like Apple Pay, banks have been sending out plastic cards as a routine. However, this practice is gradually declining."

Swish and e-invoices boast the smallest environmental footprints.

According to Niklas Arvidsson, the study's most surprising result is the low impact Swedish payments have on the climate, contributing just 0.01% to national emissions.

Crises mean increased cash handling

Despite cash's drawbacks, its resilience in times of crisis offers unique advantages.

“With the pandemic and conflicts like the war in Ukraine, Swedes continue to increase digital payments at the same time as we note an increased cash handling. Swedes have probably listened to MSB and stockpiled cash, “ observes Arvidsson.

Have you stashed away cash in the drawers at home?

“Haha, not yet.”

Text: Anna Gullers ( agullers@kth.se )